-

Analysis

- 5 Dec 2025

How World Cup Qualifiers Influence Players’ Market Value

World Cup qualifiers aren’t just about earning a spot in football’s biggest tournament.

They’re a chance for players to prove themselves on a global stage. Every goal, assist, and strong defensive performance can catch the eye of scouts and clubs, sometimes changing a player’s market value almost overnight.

World Cup qualifiers do something to the global football market that regular league matches simply can’t replicate. So, whenever a national team shirt goes on during this competition, the entire world is watching. And with that spotlight comes something else: big market value changes. Some players explode in popularity overnight, while others stagnate or even fall behind.

World Cup qualifiers do to the global football market what competition does in the world of online casinos. Some players skyrocket in value and popularity. And it’s just like specific casino platforms that introduce new features and climb the rankings on sites like Slotozilla. Meanwhile, others that offer nothing fresh or unique stagnate or even lose their ratings, gradually dropping out of the rankings of the best.

The 2026 World Cup qualifiers were no different. In fact, they might be among the most influential qualification cycles in the sport over the past decade. With social media moments going viral, unexpected underdog runs, and insane competition in Europe, Africa, South America, and Asia, player valuations shifted faster than usual.

General Market Trends After the World Cup National Team Qualifiers

The qualifiers didn’t just change the rankings table; they also reshuffled the entire global sports market. And interestingly, these changes weren’t random. Clear patterns were showing which types of players benefited, which leagues became more attractive, and how qualification success boosted reputations. Below is a breakdown of the big market:

Attackers Saw the Highest Growth

Strikers and attacking midfielders experienced the strongest value jumps because qualifiers often come down to big scoring moments like the last-minute goal, the clutch penalty, or the assist that keeps the dream alive. And attackers who delivered those moments saw their cash evaluations soar once the dust settled.

Young Players Benefited More Than Veteran Stars

Players aged 18–24 gained the most percentage-wise. This is because many scouts and analysts in the sport are constantly looking for long-term potential, which old players don’t have. Below are the major reasons:

- More years ahead;

- Higher resale value;

- Ability to adapt;

- Improved physical conditions.

Even when older players performed better statistically, the market leaned toward youth potential.

Players From Qualifying Teams Saw a Bigger Boost

When a team qualifies early or dominantly, analysts start looking more closely at their squad. Players from teams that barely qualified also improved, but not by the same margin.

Some Regions Outperformed Expectations

They were also underrated regions with players that caught the attention of many football fans and kept them glued to their screens. These regions experienced significant market value growth. For example:

- Eastern Europe: Dynamic midfielders and full-backs;

- West & North Africa: Attackers and keepers;

- South America: Emerging forwards;

- East Asia: Tactical defenders.

Factors Behind the Largest Value Increases

It’s easy to say a player’s value increased, but why it increased is the real story. Across multiple international stages, certain performance patterns appeared again and again. Here are the main reasons why some players’ valuations skyrocketed during qualifiers:

Big Individual Performances in a Single Season

Players who delivered standout matches, even if just one or two, immediately caught global attention. For instance, Newcastle's new striker, Nick Woltemade, stood out by scoring two goals against Luxembourg during the qualifying rounds, helping Germany qualify for the 2026 World Cup. This increased his value significantly and has made him one of the important players to watch next summer.

Moreover, with how fast football content spreads today, a single viral highlight like a long-range strike or a dramatic last-second scoring intervention can drive value up overnight.

Consistency Across the Campaign

Clubs don’t just want players who shine once — they want reliability. So the biggest valuation jumps often came from players who performed well in multiple matches, not just the headline games. A prime example is when Atletico Madrid’s forward, Julian Alvarez, played alongside La Liga and Barcelona legend Lionel Messi to win the last World Cup.

Leadership Roles

Captains, vice-captains, and naturally vocal leaders on the pitch saw significant interest. Even without monster stats like Erling Haaland's, they showed they can influence their team and push them to win last season.

Beating Higher-Ranked Teams

When a player puts in a strong performance against a top team, everyone notices. And this is often where underdog players make their mark and even set a new record.

Increased Transfer Demand

Sometimes, value rises simply because multiple clubs have similar interests and want the same profile at the same time. Shortage of talent ultimately leads to higher valuation.

Surprise Breakthroughs

Every qualification cycle has at least one player who comes out of nowhere and dominates the tournament. We’ve seen young defenders, unassuming midfielders, or attackers who suddenly find form and go on to get signed by big clubs.

Below is a table showing three players who stood out during their World Cup qualifier appearance and their change in value before and after the tournament:

| Player | Country | Market Value Before World Cup Qualifiers | Market Value After World Cup Qualifiers | Growth Percentage |

|---|---|---|---|---|

| Erling Haaland | Norway | €180m | €200m | 11.11% |

| Nick Woltemade | Germany | €100m | €120m | 20% |

| Michael Olise | France | €100m | €130m | 30% |

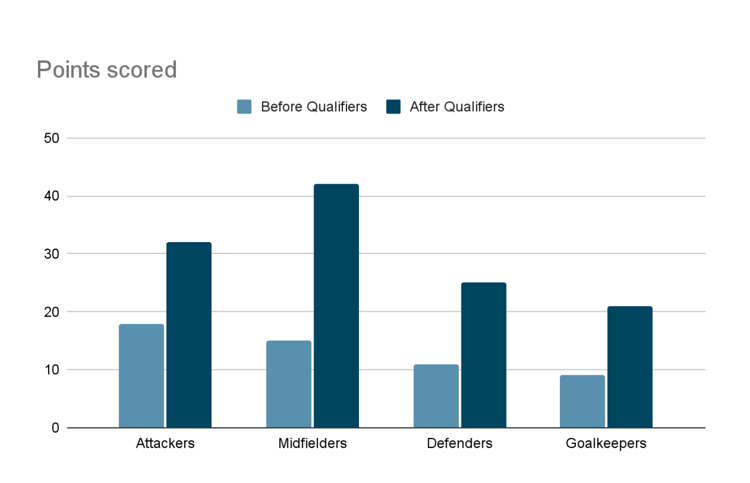

Category-Based Analysis

The qualifiers of this year’s World Cup competition were exciting and unpredictable. Many players from various positions showcased talent and played a major role in each of their team’s success. Below is a breakdown of the type of players whose market value grew:

Top Rising Attacking Players

Attacking players had the most dramatic jumps. And the biggest growth came from young forwards who scored goals at a high conversion rate and thrived under pressure last season.

Even attackers with modest stats increased in value if they played for strong qualifying teams. That’s why many good young attackers from strong football countries like England and Germany always get a surge in their value after the World Cup.

Most Improved Midfielders

Midfielders aren’t always in the spotlight like Strikers. But this year, many of them who displayed good ball distribution and high pressing efficiency saw their market value increase. Unlike club competitions like the UEFA Champions League and the Premier League, the World Cup draws viewers from almost every corner of the world.

Even people who don’t normally watch football matches tune in to support their country. So, midfielders who display creativity and play a key role in their national team’s success mostly get a boost in their value. Clubs like Liverpool, Real Madrid, and others increasingly want midfielders who can control the rhythm of play, and qualifiers showcased exactly who could do that.

Defensive Players With Major Growth

Defenders from England, France, and other countries who gained value after the qualifiers are those who displayed strong versatility, positioning intelligence, and consistent clean sheets throughout the tournament. Full-backs who combined defensive stability with attacking bursts were especially attractive.

Goalkeepers Who Gained Value

Even though the overall value of goalkeepers didn’t rise as dramatically as attackers, the value of individual keepers did rise. These are the ones who displayed prowess in saving penalties and distributing from the back.

The goalkeepers in teams with strong defensive records saw the biggest increases. Most especially the ones that showed team leadership and confidence in 1v1 situations.

Team-Based or Region-Based Value Shifts

When you look at the qualifiers as a whole, one thing becomes clear pretty fast: players from countries that qualified early usually enjoyed the biggest bumps in market value. It almost doesn’t matter whether a player is a household name like Jude Bellingham or someone breaking through for the first time; winning and stepping up at the right moment will play into the final valuation.

On the other side, players from underdog nations or regions with less global spotlight sometimes experience the most dramatic value increases as well. That’s because clubs recruit based on potential rather than fame, and a strong qualifier campaign can be the first time the world really notices someone.

That’s why many top clubs in the sport, like Liverpool, Bayern Munich, Barcelona, Real Madrid, and even Aston Villa, are filled with players of different nationalities in their roster. In fact, teams in Eastern Europe, Africa, and parts of South America often see this kind of jump, especially if their country wasn’t expected to win key matches but somehow still did.

Statistical Overview

When you look at the numbers, you can kind of feel how much the qualifiers changed everything. On average, the top over-performers saw their values jump by around 15–35%, which is a big deal considering some of these guys are still at an age where they haven’t even played a full season of games at a big club yet.

Attackers won the biggest boosts, especially after big moments; the kind that shift a whole match in the second half or silence a stadium like Camp Nou or even a heated North London Derby in England.

Midfielders and defenders also climbed steadily, while only a small group dipped a bit, usually because of form or injuries. Comparing pre- and post-qualification values almost feels like looking at two different players, especially for those coming from teams like Paris Saint-Germain or Liverpool, where every performance is magnified. Here is a graph weighing pre- and post-qualification market values by position:

Key Takeaways on State of the Transfer Market

All these sudden jumps in player valuations after the World Cup qualifiers will definitely shape how clubs behave in the upcoming windows, especially in the big Premier League and other top leagues that usually spend the most. When a player has a standout qualifying run like scoring three goals, delivering two assists, or stepping up in a crucial last match, clubs tend to react fast.

It doesn’t even take a full season anymore; one single season or even a breakthrough moment on the international stage can shift everything. We’ve seen it in major tournaments throughout history. A young talent who shines in a tight group game or survives the pressure of a potential final spot quickly becomes more expensive, and teams know they need to move early before the price climbs again.

This rise in value also creates a bit of risk, because not every player who explodes during qualifiers will maintain the same form when they return to club soccer. Some clubs remember stories like Eden Hazard, who once dominated England but struggled to replicate that magic and score goals for Real Madrid.

Still, if a player shows maturity beyond their age during qualifiers, the importance of that performance can outweigh the risk. Clubs that already spent heavily last season may hesitate.

However, others will see this as the perfect moment to invest before the next jump in value. In short, these market swings force teams to decide quickly, balance hype with long-term thinking, and hope their gamble pays off once domestic leagues start again.